“Boy, I sure got rich buying that annuity!”

“I can’t wait until the new annuities come out!”

Said no one ever.

After all, annuities are sold. They’re not something savvy investors seek out or talk about.

For most of my career, I’ve hated annuities.

My primary objection was the fees.

The Biggest Downside to Annuities — The Fees

There is a laundry list of fees for annuities. There are mortality expenses, mutual fund fees, surrender charges, and, of course, commissions.

Annuities have indeed made people rich, but it’s mostly the people who sell them. That’s because 80% of the cost structure of an annuity is the commission.

The broker or agent selling the annuity generally gets 6-8% or more of the amount invested. Not only that, it’s paid to them upfront and is more than most investments. So, it certainly can incentivize a “financial advisor” to offer an annuity product rather than a straightforward mutual fund or portfolio of stocks and bonds.

CSH’s Unique Solution for Our Clients

But annuities can play an important role in your portfolio. For one thing, you can protect your portfolio against loss with an annuity. Annuities can pay a fixed rate of interest just like a CD or give you an upside just like regular stocks or funds while protecting your downside.

For years I searched for an alternative to such outrageous commission-based products. In 2019 we signed an agreement with DPL Financial. DPL is a totally commission-free platform that works with insurance companies to design no-commission low-cost products that independent advisors and wealth managers can bring to their clients.

To show you the contrast between an agent-sold annuity product and what we can offer, let’s go through a real case study for one of our clients using real numbers.

Bernie & Janice: A Handful of Annuities and Tens of Thousands of Dollars Potentially Lost

Bernie and Janice (not their real names) had invested wisely over the years and built up a nice portfolio of investments. Bernie, who handled the finances, passed away leaving Janice with a lot of decisions to make. (By the way, one of our great joys at CSH is helping spouses who’ve never handled the finances learn to do that and make wise decisions moving forward.)

Janice was left with multiple annuities through various brokers and insurance companies. After reviewing the various annuity contracts she now owned, it was clear we could reduce her annual cost and simplify her estate at the same time. Let’s look at one of the contracts…

One of Janice’s annuities was through Met Life with an account value of $215,000. There was no surrender charge since she’d owned the contract for over 10 years. This allowed us to move it without paying a penalty to Met Life. Since Janice had done so well over time, she wasn’t as concerned about making great gains as she was protecting what she did have for her kids and grandkids.

Through conversations and assessment, we ascertained that Janice doesn’t like seeing her accounts go down, so psychologically that’s something we needed to consider. She also still wanted the opportunity to make some decent returns.

We found a no-load (no-commission) annuity with Ameritas that seemed to fit her needs. Keep in mind that we can roll Janice’s existing annuity tax-free into another annuity. If we roll it to something else or cash it out, she would have to pay tax.

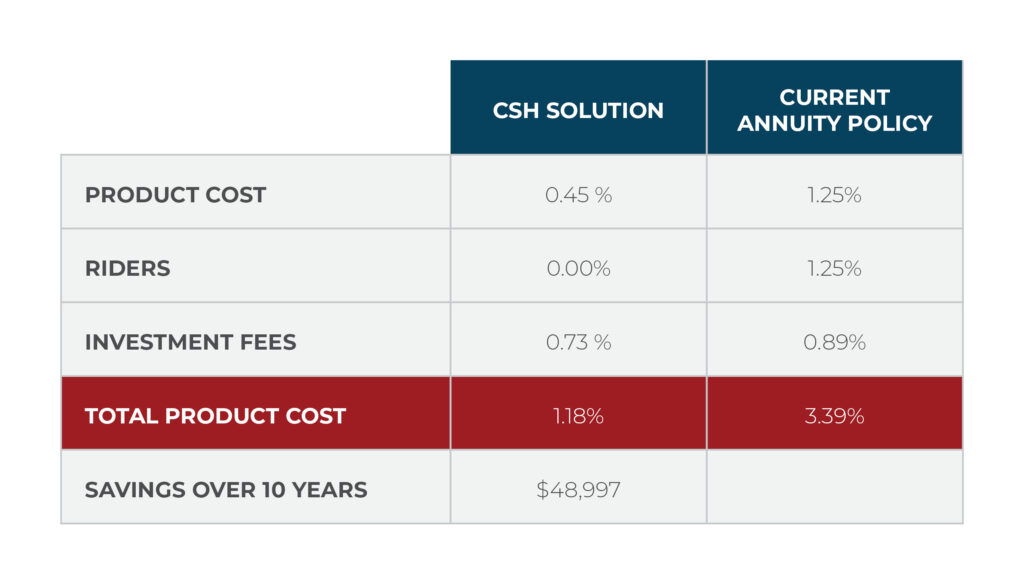

We ran a side-by-side comparison with her Met Life annuity to analyze what the difference in cost would be. In order to do a dollar-for-dollar comparison, we must assume the same rate of return for both annuities. But for simplicity purposes, here is a side-by-side breakdown of the fees:

The additional rider she paid at 1.25% a year with her current policy is obsolete in our situation. This means Janice saved over 2.21% in product cost. Why such a big difference? It’s really simple, there is no commission in our solution. 80% of the cost is gone.

However, we are in business to make money as well, so we need to add in our fee. Since Bernie and Janice have been our clients for years and have other assets with us, we charged her an annual fee of .75%. Even after our fee, she is saving over 1.5% per year. These annual savings are added back into her investment, which could result in an extra $48,997 in her account after 10 years.

Keep in mind, this is just ONE of the SIX annuity contracts Janice owned! The other five all had similar cost savings — some a little more, some less. Either way, we’re talking approximately $300,000 in savings over a 10-year period!

Additionally, the way the product we used for her is designed, she has upside to the stock market without limit. She has no surrender charge if she should want to change investments or upgrade to a new product in a few years. And her principal is guaranteed against loss, which brings us to another point…

Fixed Annuities Can Be Great CD Replacements

With rates back up, fixed annuities can be a great replacement vehicle for a CD. These are sold by insurance companies. But you must be careful.

Fixed annuities sold by insurance agents or brokers can have very long surrender periods. We’ve seen some that have 10- and 12-year surrender fees. That means the client can’t take money out without penalty until that time period expires. That can be a real problem if you need your money unexpectedly or sooner than you had planned.

We work with insurance companies that offer no-commission guaranteed fixed annuities. The penalty for early withdrawal can be very short. Usually less than 3 years or sometimes there’s no penalty at all. It depends on the contract.

Let us do a free cost comparison for you!

So, if you’re tired of low CD rates, or have an old broker or insurance agent-sold annuity, let us do a cost comparison. It’s absolutely free. And we can design the features of the product chosen to fit you and your unique situation. We tell you all the fees upfront in writing, so there are no surprises or hidden costs. Give us a call at 217-824-4211 or 573-808-1959.

You won’t get rich investing in an annuity, but it is a viable financial planning tool.