In investing we hear a lot about PE ratios. What are they and are they important?

PE ratios are a commonly used metric in investing. P, the numerator in the equation stands for price. We’ll use John Deere as an example. Today Deere trades at $525 a share. That is the P. Really simple.

The E is earnings. Deere’s earnings for the last 12 months are around $21 a share. E is the denominator. So $525 divided by $21 a share in earnings gives us a PE ratio of 25 times. In other words buying Deere stock today you are paying 25 times it’s yearly earnings.

PE ratios are highlighted on financial websites and cited by various financial media as a barometer that we can use to compare stocks and various markets. And they can be a guide for historical reference.

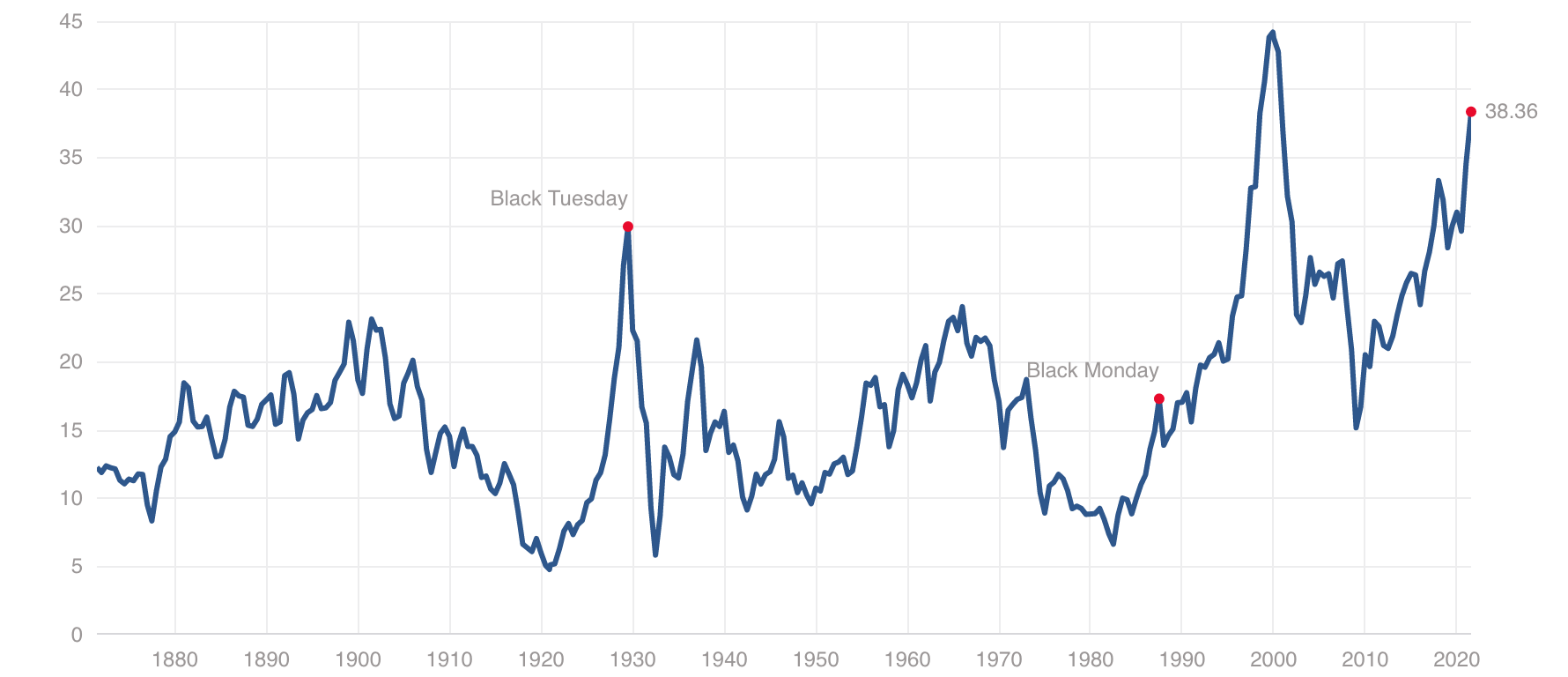

For example: The S&P 500 index sells today for around 26 times earnings. Historically the median PE ratio for stocks the last 100 years or so has been around 15 times earnings. So we can surmise that the market today is valued almost twice as high as its historical average. This could mean that stocks are expensive.

PE’s for indexes could be helpful to compare ourselves with other markets.

For instance, European stocks trade for around 16 times earnings or a PE of 16. This tells us European stocks are quite a bit cheaper than comparable stocks in the US. Actually this spread is the widest in my lifetime. By comparison international stocks are cheap compared to the US. Hmmm. this could be useful information.

We could also compare stock valuations across sectors and various countries. But you should understand that once we get into emerging markets the numbers aren’t as reliable and the businesses aren’t as high a quality. So buying the cheapest PE may not be a great strategy. But it could be an indicator that further research is required.

So PE’s can be useful, but there are also problems with relying on PE ratios at face value.

For one the E in PE stands for earnings. Earnings as measured in the US is not really a reliable number. For one, earnings are measured under the requirement of GAAP accounting or Generally Accepted Accounting Principles. Earnings measured under GAAP can greatly distort the economic reality of a business.

For example GAAP requires businesses to deduct Research & Development expense in the current year, even though this investment is used to create income far into the future. Let’s use Meta as an example. In 2022 Meta was investing nearly $7B a year in R&D in the Metaverse. This reduced the Earnings number (E) by the exact same amount. This R&D had nothing to do with Meta’s social media earnings. These losses from R&D spending were masking the profitability of Meta’s businesses and the stock took a major hit, falling nearly 70%.

These investments were strictly discretionary. In other words Meta could stop them at any time and “unmask” the true earnings of the business.

That’s what ultimately happened and Meta stock recovered all its losses and then some.

Also just using PE’s can distort and lead one to inaccurate and faulty conclusions. Lets go back to our old friend John Deere.

John Deere’s earnings are sporadic and cyclical. They go up and down with the agricultural economy, they’re not linear like a lot of businesses Over the last 15 years Deere’s earnings have fluctuated from $4.40 in 2018 to over $30 a share. At it’s low point in 2018 Deere stock traded at around $150 a share or a PE of 150/4.40 or 34. It’s all time high PE, so since it traded at its all-time high PE then was it an expensive stock?

If you think JD was an expensive stock since it traded at a high PE of 34 you would be wrong. John Deere’s stock in 2018 was actually cheap by PE standards because earnings were significantly depressed. The E in PE was too low. Earnings recovered and reached a high of $34 per share in 2023. The stock price went from $150 to nearly $400 in that time. You did really well investing at a high PE.

This happens with cyclical stocks all the time. They look statistically expensive when the opposite is in fact true. Conversely PE’s are low at the top of the cycle, when earnings are high and the stocks are actually expensive.

Because of this cyclicality and the distortion of GAAP accounting we do not use PE’s while investing in individual stocks. We like to remove all the accounting distortions and focus on FREE CASH FLOW. The earnings numbers can also be manipulated and altered. Cash flow cannot. We like to follow the cash as they say.

When a company has losses the PE ratio can also negative. This could mean a company is growing rapidly and reinvesting all its earnings back into the business. Amazon had negative earnings for years as it reinvested in it’s businesses. The PE ratio was meaningless. The growth of its discretionary cash flow was robust.

A company could have negative earnings and losses and still be a great value. For example, maybe they own very valuable real estate. Some businesses are cash poor and asset rich. in this case earnings and PE ratio’s really are meaningless. The value might be hidden somewhere on the balance sheet. The PE ratio tells us nothing about the assets or liabilities of the enterprise. It omits very valuable information.

To summarize:

- Do not rely on PE ratios when investing. Because of US accounting rules the E or earnings can be massively distorted.

- PE ratios distort the cyclicality and possible attractiveness of certain investments.

- PE ratios do not reflect the value of any assets the business might own. In other words PE ratios just focus on the income statement. They ignore any assets the company might own, or debt it might have.

- if a company is reinvesting rapidly the PE ratio could be negative or meaningless.

- It’s ok to use PE ratios to compare large indexes or large markets in general. IT can also give us a sense of where we are for historical context.

Thanks for reading my missive. If you want to learn more about our research or investment service let me know. I can be reached at steve@cshinvestments.com

C Steve Henry