Where Are We Today?

A Sense of History

As someone who has been in the markets for at least 35 years now, I’ve realized just how important it is to have a sense of history.

Of course, that knowledge is not a prerequisite for participation in the markets or even taking an advisory role in someone’s financial life. There’s no exam on financial history to be an investment advisor either. You merely need a valid identification number to participate as an investor on your own behalf.

Most in the industry take a fairly rudimentary exam to become licensed as investment advisors — and that’s it. Inexplicably, investment firms don’t usually teach classes on financial history to their representatives or have ongoing training for their teams. What’s even stranger? College curriculums are notoriously absent of any content surrounding historical perspectives on markets, interest rates, or other sectors of the financial industry.

My opinion? This is a real shame — and a missed opportunity to make a difference in the lives of the clients who are counting on us.

The history of finance is rich in many of the elements that make a great movie. Drama, intrigue, greed, and excess are all present. And while history never repeats itself in exactly the same way, as Mark Twain once said, “History doesn’t repeat itself, but it does rhyme.”

Investing in the Future — With an Eye Toward the Past

In the world of wealth management, we have your future best interests at heart. But there’s much to be learned from past experiences. So, while we invest looking forward, we are also always looking back.

We look for patterns, clues, cause and effect relationships, and data points we can use to guide us. This doesn’t mean that we have a perfect view of what’s ahead — there are still countless, unpredictable events that alter the course of the market. Trying to predict the future and invest accordingly is an exercise in absurdity. However, we do try to understand where we are today in relation to similar data points or patterns from the past.

The CAPE Ratio: A Meaningful Comparison Over Time

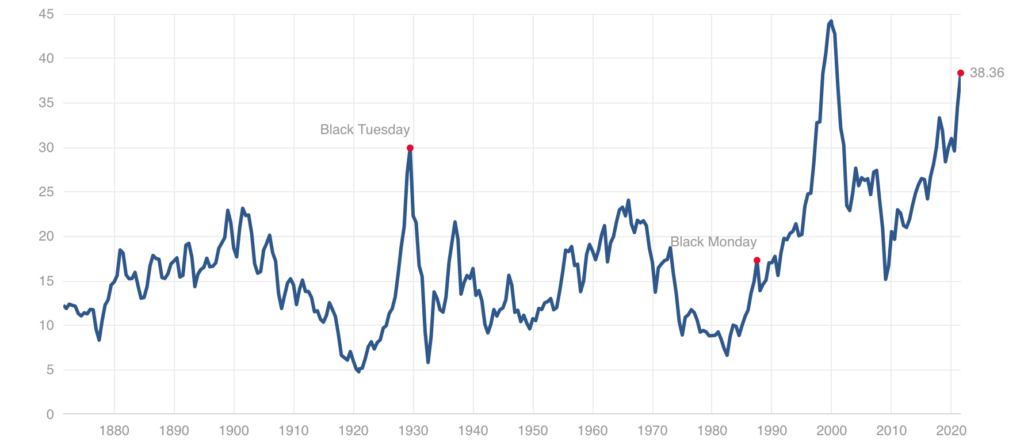

One metric that might be useful in determining how our financial present and future compare to our past is the Shiller CAPE ratio, or “cyclically adjusted price-to-earnings ratio.”

Simply put, the CAPE ratio tells us collectively how expensive stocks are as a group today. We can then compare this metric to past ratios as a barometer for our financial preset. Currently, the CAPE ratio tells us that stocks are priced higher today than they have been at any other time throughout the last 150 years — with one notable exception.

The only time that stocks have been priced higher than they currently are was when investors lost their cool during the Dot-com Bubble of 1999. This is when valuations rose quickly thanks to the bull market of the late 1990’s and the value of equity markets and a tech-dominated Nasdaq index grew exponentially. Between 2000 and 2001, this bubble burst, most dot-com stocks went bust, and it took another 13 years after that financial “party” to recoup the losses incurred.

My take on where we are now, according to the CAPE ratio?

When the CAPE ratio is in the 90th percentile as it is now, stocks will likely have an average return of about 1% over the next decade. It’s clear that to have market-beating returns going forward, one has to do something different to grow their investments.

(Source: multpl.com/shiller.pe)

The Status of Our Melt-Up Theory

If you’ve been following along with me for a while, you might remember that my thesis in 2018-19 was that a market like the one we’ve seen is going to “melt up,” meaning that we will see a sharp upward trend that indicates the end of a bull market.

In other words? We may still see the market reach unprecedented levels. After all, we’ve had unprecedented government stimulus and artificially low interest rates. The result of this combination is that risk asset prices have increased. We are also seeing stocks climb to record levels and bonds escalating higher than anyone could have anticipated. Stocks and asset prices may still go higher and stay higher longer than anyone could have predicted.

It seems we may have another historical moment in the making.

The S&P 500 index of stocks advanced an astonishing 14% in the first half of this year. This has only happened 13 times since 1950. On nine of these occasions, the market ended the year at even higher levels, and the average gain for those last 6 months in these instances was 6%.

The lesson here? Don’t stand in front of a bull market.

Are Bonds Shaping Up to Be Guaranteed Losses?

Investors have traditionally looked to bonds as safe havens; a place to put away money and not worry too much about risk. But this isn’t always necessarily the case.

Conservative investors found out that bonds weren’t always a sure thing during the 1970s. Over the course of just a few years, interest rates spiked from 5-6% in 1975 to nearly 12% by decade end. This doubling of interest rates hacked nearly half of the value off of bonds that had been purchased earlier in the decade. Imagine one’s surprise to realize their “safe investment” just got cut in half.

Back then no one had visualized or anticipated such high interest rates. The problem then was inflation. The antidote to these inflation woes was to raise rates higher and higher. The prescription worked. But the fallout of this solution was rapidly falling bond prices.

Bonds in Today’s Market

With interest rates falling to record lows today, it’s not beyond the realm of imagination to see rates double over the next 5 to 7 years. Knowing what we know about bonds historically, it’s easy to picture a bond-heavy portfolio being wrecked beyond recognition: The next great halving.

The reemergence of inflation in 2021 makes the current bond landscape all the more difficult. With inflation at 4.2%, a U.S. Treasury bond yielding 1.5% actually earns bondholders a loss of 2.7% in real terms. It’s like a melting ice cube in regards to purchasing power. In other words? It’s your wallet shrinking right before your eyes.

Today, many pension funds and endowments are operating with assumptions of a 7% rate of return for their funding calculations over the next decade for a portfolio of stocks and bonds.

This 7% assumption is a blended rate of both stocks and bonds. If a client has a 50-50 portfolio and bonds somehow eke out a 2% annual return, this means that the stocks in their portfolio would have to return 12% annually to meet funding requirements.

The problem here? We know from our CAPE ratio analysis that returns on markets have only managed to eke out modest gains when markets are this high.

This isn’t cause for panic, but it does mean it’s time to pay attention. While these assumption rates have come down, it’s going to be a difficult road ahead for most. The pension funding crisis in this country is just starting — and it’s going to be uglier than you can imagine. With real returns well below the 7% target, the crisis can only be solved at the distribution level.

This leads to our next point:

The Faulty Logic of the 60-40 Portfolio

History tells us that the 60-40 portfolio has done its job over the last 50 years.

This has worked because historically, when stocks have been expensive, bonds have been cheaper, and vice-versa. This allocation over time has returned around 7% with less risk than an all-stock portfolio. Really, it’s not a bad deal at all.

Over the last decade, stocks and bonds have risen together in lock-step. Due to market manipulations by decision-makers, the historical relationship between these two has been severed. Never before in history have stocks and bonds been so expensive at the exact same time. They are essentially correlated: One goes up, the other goes up, too.

Many brokerage firms are still advocating the usage of a 60-40 portfolio. You can search the web for the term “60-40 portfolio” and find all kinds of articles supporting this theory.

However, it’s important to understand how the firms who are authoring these articles make their money. If someone sells stocks and bonds for a living, it’s in their interest to push those products. It wouldn’t make sense for their bottom line to offer alternative options.

My take on what’s happening right now? History will prove that the 60-40 portfolio won’t work this time. You can read more about that here.

Cheap Investments Still Exist Today. They’re Just Not Mainstream.

There are sectors and individual securities that have not participated in the bull market of the last decade. Today they are cheap — and seemingly hated.

How about commodities? A basket of commodities as measured by the GSCI commodity index has lost money over the last 25 years. But with the advent of this current period of inflation, the valuation of many of these companies has risen 50-60% this year.

This is just the beginning of a new bull market.

Several of our core investments are within the “buy” range again — as of today. These investment opportunities have attractive traits, including high returns on capital, high and stable cash flows, and healthy and growing margins. They all have competitive advantages within their industries and have low and manageable debt loads.

- The housing market — and all the components, suppliers, and materials that go in it — are in great demand. This is a long-term trend that can’t be ignored.

- There is a pent-up and long-term demand for a number of travel stocks. Many of these were added toward the bottom of the market in 2020.

- There are exciting and burgeoning industries such as electric vehicles and cybersecurity with plenty of investing promise for the years ahead. The Internet of Things is changing how we live, work, and interact with things and each other. it also offers a prime opportunity for investment and long-term growth.

- Blockchain technology and cryptocurrencies are ushering in a new economy and new investment potential. New blockchain businesses may well change the way we interact, and maybe even the way we live.

The next decade will be hard for many, but truthfully, this is also an exciting time to be alive and working in this business. Those who know the history of the market can see that while uncertainty lies ahead, so does the potential for new industries to pull ahead and forge new paths for those looking for valuable, meaningful investments.

A Better Way of Thinking

Just like we’ve seen with the problematic promise of security with the bond market, the investment establishment wants you to be in the dark. That way you will need them: Zombie investors with no life, and no thought for anything but the next “meal” of short-term promises.

At CSH Investment Management, we eschew the establishment. We have a better way.

In our experience, we’ve discovered many investors don’t understand the inordinate risk they take to earn meager market returns. Understanding and managing risk is going to be more important today and in the coming years than trying to get a slightly better return.

Personally, I’ve spent the last 40+ years studying the markets and learning investment research techniques at places like Columbia Business School. I’m passionate about what we can learn from the past and what we can take into the future. It’s not just a job for me.

I love the history of our market, solving the problems we see ahead, studying great investors from all disciplines, and discovering the patterns others dismiss. And this knowledge has given me a fuller understanding of hedging techniques such as option strategies, which allows me and my team to see how these tools can be applied to reduce risk in a portfolio — not increase it as everyone thinks.

This is a unique time in our financial history. And making the most of it is going to call for a culmination and application of everything I have learned up to this point.

You see, it’s not just looking at a few metrics. It’s understanding what lies beneath:

- How were those good returns made?

- Are they sustainable?

- What assumptions are you making by extrapolating the past into the future?

The returns up to and including today are irrelevant. The next 10 years will be the most important of your investing life. And of mine.

So remember:

1) History can’t tell us where we are going, but it can certainly help us understand where we are.

2) Markets can go to the extreme. You must have a plan to participate and to exit, when necessary.

3) Bonds can give investors a false sense of security. Don’t fall for it and be forced to suffer the losses.

4) The masses still believe in a traditional 60-40 mutual fund portfolio format. We feel that this is inefficient and that their judgment is shaded by legacy market forces.

5) At CSH Investment Management, we have a better way forward.

Reach Out to Us!

Do you have questions or concerns about your investment strategies, retirement plans, inheritance, business succession, or wealth management? Give us a call at 217-824-4211 or contact us on our website.

We are obsessed with doing things well and serving our clients as if they were our own family. We’re happy to talk with you any time!

With gratitude,

Steve Henry

Certified Financial Planner

Registered Investment Advisor