How to Build and Protect Your Portfolio in the Coming Decade

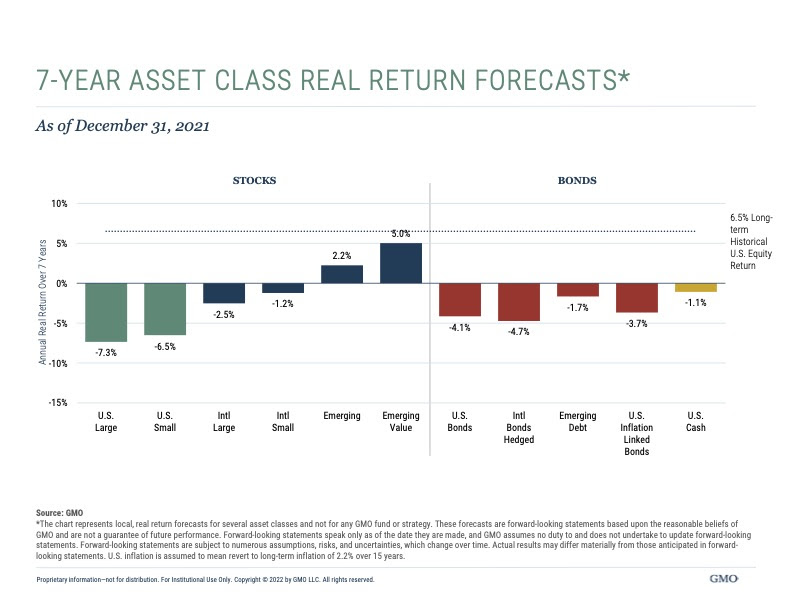

So the future forecast for stock and bond returns looks dismal, doesn’t it? To remind you of my last missive, I’ve included the 7-year forecast for stocks and bonds below. Today, we’re going to get specific about how to invest in a tricky environment.

This graph begs two questions:

How do you protect yourself from the coming challenges?

How do you make money in the coming years? Will 8-10% annual returns even be attainable?

First off, I don’t know how the next decade will play out.

At times, markets have gone higher than anyone could have thought. Just look at Japan. The Nikkei, Japan’s version of the S&P 500 peaked in 1989 at 38,000. Today it sits at 26,000. It’s been 33 years and people are still waiting for it to get back to the starting point.

Interestingly, the US is embracing many of the same policies that Japan did at that time — massive stimulus, interest rates at almost zero. So far the Fed has ridden to the rescue of the stock market. That’s because they could do so without disrupting other important economic variables. Inflation is a bigger problem than a falling stock market, and the policy wizards have forewarned us that they will slay that dragon first. In other words, the Fed could come to the rescue when there aren’t more important and damaging issues to solve. Inflation simply hasn’t been an issue in the recent past.

But this is an investment newsletter, not an economic newsletter, so let’s talk about how to invest in such a tricky environment.

I have no crystal ball or insight into the future. I just understand that the catalysts are already in place — inflation and looming interest.

I think history has given us a template on how to proceed, so let’s dig in.

6 Things to Look for and Consider in the Near Future

In today’s post, we’ll briefly touch on each of the following:

- Capital efficient businesses with high returns on capital

- Value vs Growth Stocks

- Cash

- Hedges

- The value of cash and hedging

- Bitcoin/Gold/Silver

1. Capital efficient businesses with high returns on capital

We’re starting with the most important consideration. It’s best illustrated by an example. Suppose I have a widget manufacturing business. In an inflationary environment, the cost of making my widget goes up. If interest rates rise, so will my cost of borrowing. In an environment like today’s, I have two factors going against me. In response, I can increase my retail price and pass on these costs. (But only to a certain point.) If the item is discretionary, people will wait to buy the product, or not buy it at all. They might even find a substitute. Only if there is something unique about my product will people continue to buy it.

Now let’s look at a capital-efficient business. Let’s use Microsoft as an example. Microsoft does not require a lot of capital expenditure to keep its business running. It’s essentially software delivery. Also, they can pass on cost increases more subtly. Microsoft’s enterprise products are mission-critical for nearly all large companies.

Being capital-efficient allows them to reinvest more of every dollar back into the business even after paying out dividends and share buybacks.

There are clues to scan for capital-efficient businesses. One is Return on Invested Capital. Microsoft’s ROIC for 2021 was 29.8%. For every dollar invested in the company, 30 cents is converted to cash flow.

In an inflationary environment, Microsoft will do just fine while my widget business struggles. So owning high-return-on-capital businesses is one key to long-term returns.

2. Value vs Growth Stocks

Academics, as well as the market media, like to break stocks down into two categories: value versus growth.

However, we see these two concepts as not mutually exclusive. Ideally, growth will be a component of value. They are essentially two concepts that could be joined at the hip. But when we talk about value stocks we are essentially talking about stocks that meet certain metrics. Value stocks have low P/Es or price to earnings. In other words, they’re cheaper than stocks that are considered highflyers.

Let’s look at an example. One we like is Atkore. Atkore makes tubing for industrial use and infrastructure projects — basically conduit. The company’s return on capital is 16%. At that rate, it certainly won’t be confused with Microsoft. But its stock is selling for 7 times earnings or 7X. Given the S&P 500 index trades at 26X earnings, this seems super cheap.

Think of it this way, if I was buying Atkore as a business, if I paid $100k today, I would get back $14k in earnings per year. $100,000/14,000 gives us a 7% or a 14% yield on our investment. That’s value.

Historically, value stocks have outperformed growth stocks by a pretty good margin. But in the last 10 years that certainly has not been the case. Traditional value stocks have not performed well at all. Not just in the US but worldwide. Over the last decade, growth has outperformed value by 9.5% per year. A stunning and unprecedented gap of 90%.

In bull markets capital flows to businesses that are growing at very high rates. The problem is this thesis is not sustainable over time and through a complete cycle. The higher a stock goes, the more optimism that is baked into the price. It takes very little bad news to tank a high-flying growth stock. Some don’t recover for decades.

In bear (down) markets, value performs very well. There are more modest assumptions built into the price. Investors see this and capital begins to flow back into value at the expense of growth. Just remember the larger the disparity between growth and value stocks, the greater the snapback. This is the time to understand value.

3. Cash

It has been proven that investment managers that hold large amounts of cash going into a correction and bear market do very well over time. In fact, they tend to outperform their fully invested brethren. In most cases, we think of cash as US Treasuries. Historically, treasuries have provided an adequate return during times of crisis. I began my career in the era of 5-7% Treasury yields.

The graph above forecasts cash as a better investment than any other bonds whether they are corporate, high yield, or government. But its negative long-term return shouldn’t excite a long-term investor.

Today, the US Treasury gives you a payout of only 1%. Not very attractive given inflation is running at 7%. You basically lose money every month. So we have had to come up with an alternative to cash. Suffice it to say it is stable and goes up with inflation or increases in value as credit spreads widen. In the interim, we get a nearly 4% yield.

4. Hedges

There are many tools for hedging or protecting an investment portfolio. The remedies against a market downturn or bear market are wide and varied.

Many retail investors like to use inverse ETFs. These are designed to go up when the S&P falls. These investments are typically leveraged 2 to 1 and sometimes 3 to 1. Typically these are marketed to do-it-yourself investors. That’s because professionals should know better. These are poor tools to hedge and can be dangerous because of the way they are designed they tend to erode over time. So your investment continually deteriorates even if the market goes sideways. These are trading instruments best left to the uninitiated.

A better tool for hedging in today’s environment is put options. Think of this as an insurance policy. For a set premium you can protect X amount of dollar movement in the market. The downside is it can eat into your returns over time as options expire just like any insurance policy. So it should be used strategically and sparingly. In fact, we have not used put option strategies in our business until 2 years ago. Today, options are a good way to protect your capital. If you’ve made 40% or more the last 3 years it seems reasonable to take 1-2% and buy some puts.

This isn’t the only way to hedge. There are new tools available to give us the result we need. Market inverse ETFs exist but you must understand the structure and how they get returned before you spend any money there.

5. The value of cash and hedging

It should be apparent to you by now that any hedging strategy can be a drag on short-term returns. It’s important to understand that should a bear market or correction occur, your hedges now become a source of cash to invest.

If you’re fully invested during a down market it can be excruciating psychologically. There’s really nothing to do but just sit and wait it out. Hedging and cash allow you to participate when no one else can.

Over time we have built a database of high-return-on-capital businesses that we would love to own. The only hurdle is a much lower price to meet our return demands. Having cash when most managers are scrambling and hoping is a great position to be in.

One last point to hedging. Hedging a portfolio allows you to stay aggressively invested in securities you really like. The alternative is to sit on cash equivalents that essentially earn zero.

6. Bitcoin/Gold/Silver

If you bought some Bitcoin when I told you to in the 4th quarter of 2019… congratulations. You are up 360%. But I still wouldn’t commit any more than 10% of my investable assets into crypto.

The best and the brightest aren’t showing up at the door of Facebook and Google to work these days. They are leaving traditional tech companies to work at crypto startups. But the future of the fastest growing industry is not well defined. Bitcoin’s volatility obfuscates its utility as a currency.

But if you grew up in Latin America you understand the value of a predefined quantity of money. Argentine business owners have lived through multiple massive devaluations that have wiped out their net worth. In light of that, it’s not hard to understand crypto’s popularity.

However, it is still just a software program. It’s hard to imagine a store of value that can be lost at a keystroke as a long-term solution. I have a hard time getting past that little tidbit.

Digital gold’s forerunner is actual gold or, its industrial brother, silver. Gold’s durability is its saving grace. If you freeze or melt an ounce of gold you still have an ounce of gold. That is its value. A hedge against inflation or catastrophe.

Silver’s industrial uses are multiplying with the advent of the electric automotive industry. Silver is a major component in Electric Vehicles (EV). It has been estimated that a 20% increase in EV usage would require a 300% increase in silver mining output. Other base metal inputs will require even higher investment. It’s clear that silver has to go up – maybe a lot – to satisfy future needs. It’s ironic that the transition to energy efficiency might be costlier to the environment over time than where we are today. If the treatment starts to trump the disease, environmentalists will have to pick their fight.

I could go on. (As you may know by now, I LOVE what I do.) But let’s boil it down:

Emerging markets are cheap, thus their higher forecast return in the graph above. We have lower-risk preferred ways to get the exposure we need. There are still ways to invest in such a tricky environment.

So what does all this have to do with CSH and YOU??

The point is… there is much to do.

A dreadful future forecast shouldn’t scare you. Many of the great investors built their businesses and reputations in such historical times.

At CSH Investment Management LLC, we think high single-digit returns over the decade are attainable. You must have a plan and a process to implement that plan, though. It’s hard to tell just how an investment might react during a crisis or a bear market. You simply can’t predict. But you can understand why things happen the way they do. As the proverbial saying goes, “History doesn’t repeat itself, but it does rhyme.”

No matter what, CSH will be here in these interesting times. And we will not stop reading, learning, or working to protect your money and get you the best returns possible. If you have any questions or would like to make an appointment to speak with us, give us a call at 217-824-4211 or contact us via our website. We’ll be happy to speak with you!